Jeff Devine was quoted in a Bond Buyer article, entitled, “Munis firmer, NYC water deal upsized to $950M”

Read Article

Jeff Devine was quoted in a Bond Buyer article, entitled, “Brightline West's $2.5 billion bond pricing 'too attractive to ignore'.”

Read Article

While recent fixed income returns have been disappointing, there are several reasons to be optimistic about the asset class.

Read ArticleWe use cookies to improve your experience on our website. To accept cookies click Accept & Close, or continue browsing as normal. For more information or to learn how to opt out of cookies, please see our cookie policy.

Accept and CloseGW&K's CIO and Portfolio Managers share their insights and opinions on the economy and market each quarter.

Firm-wide

Equity Research Analyst Gaby Greenman shares insights from the companies she follows, providing a direct look at how businesses are thinking about consumer demand and their outlook for the months ahead.

Read ArticleMunicipal Bond

Fiscal conditions across state governments remain healthy as the sector heads into 2025.

Read Article

GW&K Municipal Bond Market Insights

GW&K Portfolio Manager Kara South and Client Portfolio Manager Michael Rabuffo review recent volatility in the municipal bond market and discuss:

Transcript

Michael: Hello, my name is Michael Rabuffo, Principal and Client Portfolio Manager here at GW&K. I’m joined by Kara South, Partner and Portfolio Manager on our Municipal Bond Team. We wanted to provide an update on the municipal market and answer some questions we’re getting from clients.

Kara, there’s been some volatility in the fixed income markets this year. Could you talk about some of the specific drivers impacting the municipal bond market?

Kara: Sure. One of the biggest drivers of performance for the muni market has really been the broader macro factors that have led to the sell-off in the Treasury market — so, higher yields and a steeper curve.

If you think about where we entered the year, the market expectations around the US Federal Reserve (Fed) were for up to six cuts, which would have been an implied fed funds rate below 4%. Obviously, as the year progressed, the economy held up better than expected.

On the inflation side, we have made progress towards the Fed’s 2% target, and we saw some cooling in the labor markets, which enabled the Fed to kick off their first easing cycle in over four years in September with a 50 basis point cut. But in general, inflation has sort of remained above that 3% level, so stubbornly high. I think that’s led to some caution that’s been priced into the long end of the Treasury market.

The other factor I would just highlight is as far as the election and some of the uncertainty there around policy and concerns about tariffs, restrictions around immigration, and deficits has put some additional pressure on that long end of the broader Treasury market.

More specifically to municipals, we entered the year at relatively rich muni/Treasury ratios, and because of that, our market had less ability to absorb that sell-off that we saw within Treasuries.

Another factor was just elevated supply: We’re on track to have over $500 billion this year, which would be a record for us. I would say, in general, it’s been relatively well absorbed, but it is an elevated amount.

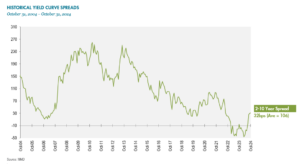

Michael: We saw the municipal yield curve invert in 2023. How did that change your thinking, and how is the slope of the curve today?

Kara: The muni yield curve inverted in February 2023, with the 2s/10s spread turning negative, and it remained inverted for most of the year. This was actually the first time that we’ve ever had the muni curve invert, even during prior periods in which the Treasury curve inverted. So it’s been a unique period for us.

Historically, we found the best risk-adjusted return in that intermediate part of the curve, just based on yield and bond roll and that’s where the majority of our buying has been. With this inverted yield curve, we kind of shifted a little bit of our buying to the short end and the long end since that was out-yielding the intermediate part of the curve just to capture the higher yields in that part of the part of the market.

With the Fed kicking off its easing cycle starting back in August of this year, we did see some normalization in our curve with the 2s/10s spread returning to positive, and with that, now we see better expected return in that intermediate part of the curve to around 50 basis points from that roll within the portfolio. So we’re now doing more buying there in a very measured way.

Source: MMD AA Yields 10/31/24. Reflects current yield of AA-rated callable bonds based upon the MMD benchmark curve, as of the date shown. “Expected return” for a bond with a particular maturity is the one year return a bond would have if there were no changes to the yield curve calculated using the following formula: (price change + coupon) / beginning price. “Roll” is an approximation of performance contribution that is calculated by subtracting yield (based on MMD benchmark curve) from expected return. These calculations assume that interest rates do not change during the life of the bonds. Actual performance is not guaranteed. The expected returns shown are provided for illustrative purposes only and do not represent actual returns realized by the Municipal Bond Plus Strategy. Hypothetical performance results have certain inherent limitations. Such results do not represent the impact that material economic and market factors might have on bond returns or an investment adviser’s decision-making process if the adviser were actually managing client money.

Michael: There’s been some differences in performance this year, depending on credit quality. Could you talk about some of the outperformance we’ve seen in the lower-quality segments in the market?

Kara: Sure. First, I would just say credit quality within the muni market remains extremely strong. A lot of that was driven just by the strong revenue growth that we saw coming out of the pandemic — the federal aid and support that was received enabled states to really build up a record amount of reserves. With that dynamic, we saw a lot of upgrades within our market with improving credit quality, which has just led to fewer lower-rated credits within our market, which was already a relatively smaller portion.

A part of the market where this has been particularly true — and it’s really been heightened this year — was within the high-yield segment of the market, which has seen pretty strong performance this year, with a lot of that really being technically driven. So, sort of that imbalance between supply and demand: not a lot of issuance, but really strong demand given the yields that are available in that part of the market, coupled with no real concerns about fundamentals.

Michael: What is your near- to mid-term outlook for municipals?

Kara: We’ve seen a lot of volatility within our market more recently, but our long-term outlook for the muni market remains favorable, supported by the strong credit quality within our market as well as historically attractive yields.

If you look at our 10-year AAA muni yields, we are off of the peak that we saw in November of last year. But if you take a longer-term perspective, and you look at the 10-year average, we’re about 100 basis points above that average. So, from a longer-term perspective, yields are very attractive right now within the market.

Demand for our market remains strong — part of that driven by those attractive yields, especially on a on a tax-equivalent basis. Thinking of an individual in the highest federal tax bracket, you’re looking at close to 5.5% yield for an intermediate type of strategy, which I think is pretty compelling. There’s a lot of cash sitting on the sidelines that I think, as there gets to be more clarity around policy, will likely come off and continue to be an additional demand factor.

I would also just mention, we entered the year at relatively rich muni/Treasury ratios, and throughout the year we have seen those improve a little bit. I think that was one factor that was keeping people on the sidelines a little bit but are improved from where they were — still not back to that long-term average, but in a much better place.

Michael: You mentioned policy. The election is now behind us. Could you talk a little bit about the election and how there could be some impacts to municipal bonds?

Kara: The biggest direct impact will come through the sunsetting of the 2017 Tax Cuts and Jobs Act at the end of 2025. With the administration right now, the expectation is that they’ll continue with the current tax regime so that will be more of a status quo for our market.

One element I would highlight is around the State and Local Tax (SALT) Deduction and potential for that cap to be removed, which has potential within the muni market to lead to less demand for in-state bonds in high-tax states. That’s something that’s a little bit more muni specific. The nearer-term impact will likely be more indirect and felt through the Treasury market, so to the extent that there are concerns about higher tariffs, restrictions around immigration, around the deficit, and what that means for Treasury yields — whether that’s higher yields or a steeper curve — that will play out into the muni market as well, but more of an indirect impact there.

Michael: Thank you for your insights. I hope this is really helpful to all of GW&K clients. Thank you for your time.

Kara M. South, CFA

Partner, Municipal Portfolio ManagerMichael V. Rabuffo, CFA

Principal, Client Portfolio ManagerDisclosures

This represents the views and opinions of GW&K Investment Management. It does not constitute investment advice or an offer or solicitation to purchase or sell any security and is subject to change at any time due to changes in market or economic conditions. The comments should not be construed as a recommendation of individual holdings or market sectors, but as an illustration of broader themes.